App•Africa

Africa in the Cloud.

Whether you want to create a simple page for your startup, a blog, a portfolio or all of the above, our easy to use templates and design tools make it easy to create an online presence.

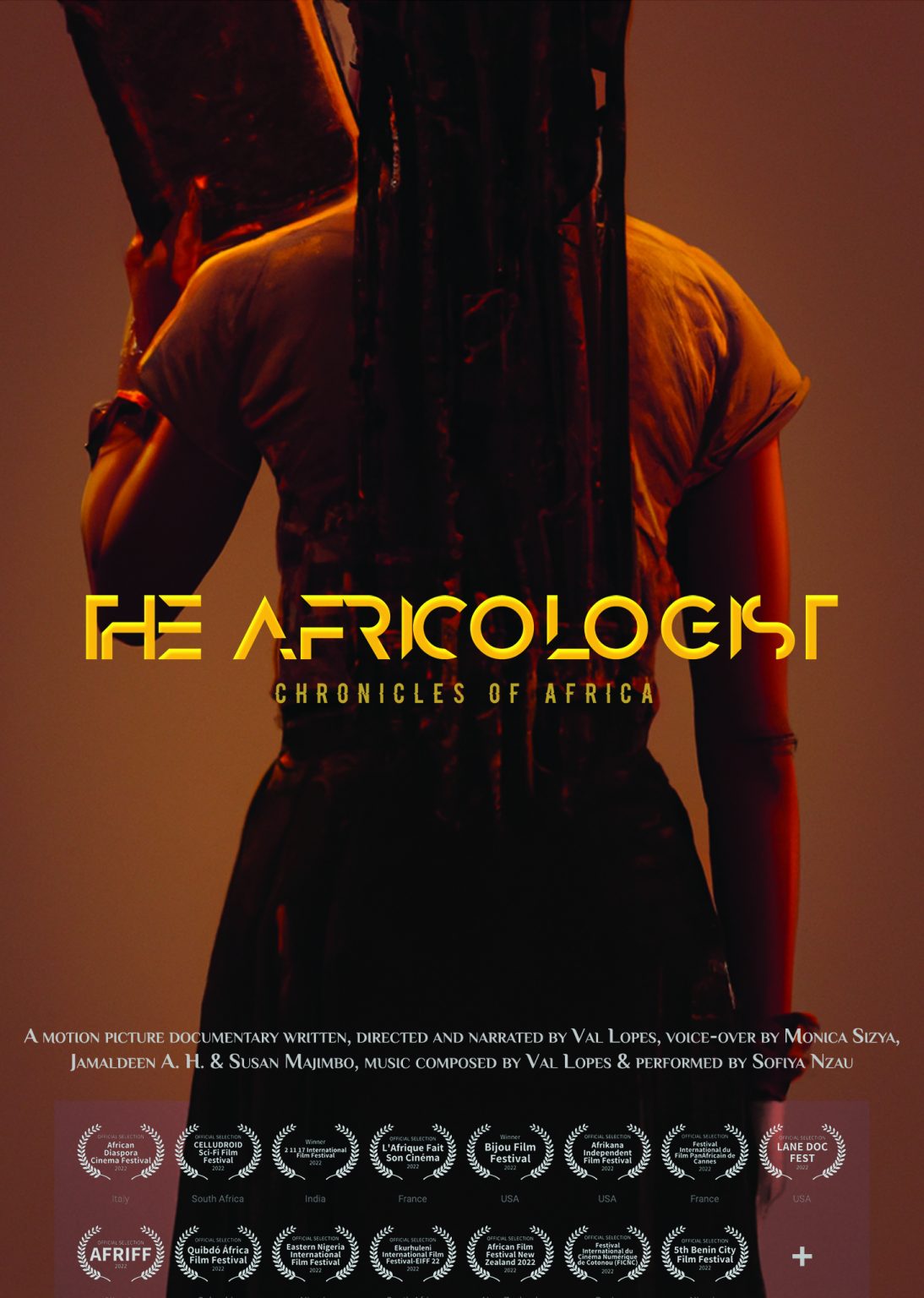

The Africologist, Chronicles of Africa

Documentary Film

Join the Africologist, the virtual explorer and Val Lopes, the real world storyteller on a sensational journey through space and time as they unveil and relate the chronicles of Africa.

Encyclopedia

This resource delves deeply into African philosophical, cultural, and social concepts. With meticulously researched entries and AI reinforced content, this treasure trove illuminates the vibrant history and enduring contributions of African thought and traditions.

Courses

Our bite-sized lessons are ever evolving knowledge sets for the digital job market, they help you build the in-demand skills you need to succeed. Our AI-assisted and inquiry-based instruction methodologies are highly effective and yield fantastic results.

Publications

This publication space is dedicated to the exploration and dissemination of African philosophical, cultural, and social concepts. It features scholarly articles, thought-provoking commentaries, and insightful reviews that foster a deeper understanding of Africa's narratives.

Services

Content Creation

We offer StoryTelling as a Service.

Product Design

We are digital and analogue craftsman.

Africology

We help you understand all aspects of Africa.